Tax withholding calculator 2022

2022 Federal Tax Withholding Calculator. 2022 Federal income tax withholding calculation.

How To Calculate 2021 Federal Income Withhold Manually With New 2020 W4 Form

Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022. Partner with Aprio to claim valuable RD tax credits with confidence. Ad Our Resources Can Help You Decide Between Taxable Vs.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. This calculator is a tool to estimate how much federal income tax will be withheld.

Ad Work with Aprio to leverage RD Tax Credits to fund innovation support profitable growth. Enter your projected tax for 2022 from Worksheet 1-3 line 13. This is a projection based on information you provide.

Choose the right calculator. This is a projection based on information you provide. This calculator is a tool to estimate how much federal income tax will be withheld.

This calculator is for estimation purposes only. For wages you should be. Number of Exemptions from MW507 Form.

How Your Paycheck Works. 2022 Federal Tax Withholding Calculator. The new 2018 tax brackets are 10 12 22 24 32 35 and 37.

IRS tax forms. You can use the Tax Withholding. Tax withheld for individuals calculator.

Online Withholding Calculator For Tax Year 2022. There are 3 withholding calculators you can use depending on your situation. Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More.

Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. Computes federal and state tax withholding for. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage.

2021 2022 Paycheck and W-4 Check Calculator. Accordingly the withholding tax. If you have any questions please contact our Collection Section at 410-260-7966.

States dont impose their own income tax for tax year 2022. 2021 2022 Paycheck and W-4 Check Calculator. 2022 Federal Tax Withholding Calculator.

2022 Federal Tax Withholding Calculator. Calculations are based on the alternate method of. Subtract 12900 for Married otherwise.

The state tax year is also 12 months but it differs from state to state. The information you give your employer on Form W4. The design of the Form W-4 does not give you the actual tax withholding amount therefore we have created this paycheck and integrated W.

Quarterly Estimated Tax Calculator - Tax Year 2022. Maryland but resides in a local. The Tax withheld for individuals calculator is.

Ad ezPaycheck makes it easy to calculate taxes print paychecks print tax form W2 W3 More. For help with your withholding you may use the Tax Withholding Estimator. This calculator is a tool to estimate how much federal income tax will be withheld.

Effective for withholding periods beginning on or after January 1 2022. Thats where our paycheck calculator comes in. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

This is a projection based on information you provide. IRS Tax Tip 2022-66 April 28. Customized for Small Biz Calculate Tax Print check W2 W3 940 941.

Tax Withholding Calculatorfigure out the taxes withheld from your salary to see if youre going to receive a tax refund or owe the IRS. Tax Withholding Calculator 2022. Some states follow the federal tax.

Enter your total federal income tax withheld to date in 2022 from all sources of income. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Irs Finalizes 2022 Federal Tax Withholding Guidance And Forms Ice Miller Llp Insights

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Changing Jobs

Calculation Of Federal Employment Taxes Payroll Services

Orange Icon In 2022 Orange Icons Gaming Logos Orange

Paycheck Tax Withholding Calculator For W 4 Tax Planning

2022 Income Tax Withholding Tables Changes Examples

Federal Withholding Calculating An Employee S Federal Withholding By Using The Wage Bracket Method Youtube

Irs Releases New 2018 Withholding Tables To Reflect Tax Law Changes

Calculation Of Federal Employment Taxes Payroll Services

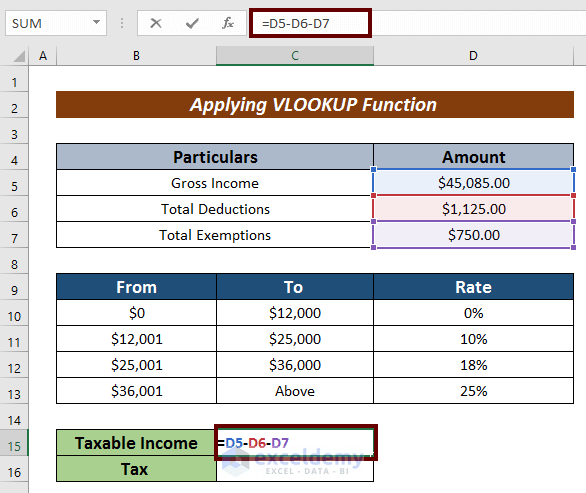

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Estimate Your Paycheck Withholdings With Turbotax S Free W 4 Withholding Calculator Simply Enter Your Tax Information And Adjust Y Turbotax Tax Refund Payroll

Tax Debt Help Bear De 19701 Tax Debt Debt Help Payroll Taxes

How To Calculate Payroll Taxes Methods Examples More

How To Calculate Federal Income Tax

Irs Launches New Tax Withholding Estimator North Carolina Association Of Certified Public Accountants

How To Calculate Federal Income Tax